Personal Loans and Responsible Lending

36MonthLoans.com has a code of practice put in place to ensure responsible lending practices: we offer personal loans focused on the borrowing needs of customers

- We assess that customers can afford loans, and are able to repay them. We have created a repayment module so customers can find out how much they can borrow and pay back.

- We provide clear, transparent customer communications.

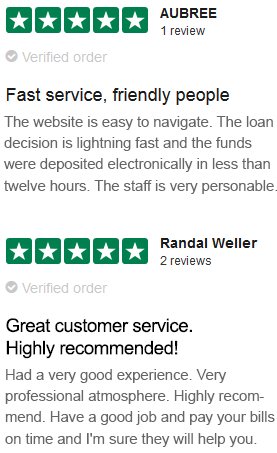

- We treat customers in a helpful, courteous manner and deliver high standards of service through all methods of communication: customer corner email center and postal mail.

We ensure that all the lenders we work with are reputable and adhere to responsible lending practices.

Choosing the Right Lender for You

36MonthLoans.com works with responsible lenders who are all licensed to lend cash to consumers in the form of personal /installment loans. Once you are matched with a lender, please make sure you check the contact details of the company in case you want to get in touch with them with any questions. It is very important that you understand their interest rates and fees if any. Also, it is very important to check the lender’s repayment options as well as what happens if you are late for a payment or miss a payment.

Late Payment

Personal loans should be used for short-term financial needs only, not as a long-term financial solution. We always highly recommend that you try to pay all your outstanding loans/bills/debts on time as this will reflect a good payment record. The lenders that we work with have their own separate terms and conditions of late payment. We highly advise you to get into contact with the lender you are matched with if you anticipate that you will be late with your payment to set up other payment arrangements. Late payment charges may apply (depending on the lender). If you are planning on extending the loan, in most cases, the finance charge for the original loan must be paid on the original due date. Your loan principal will then be deferred with an additional finance charge. However, we suggest you pay as much as possible on your original due date to reduce further charges. You must contact the lender immediately to set up payment arrangements. If your loan payment is rejected for any reason by your bank, the lender may initiate collection procedures and you will be prevented from receiving future loans from the lender

until all of your payment obligations are met in full. Again, please make sure you carefully read the late payment options/penalty from the specific lender you are matched with.Missing a Payment

We always highly recommend that you try to pay all your outstanding loans/bills/debts on time as this will reflect a good payment record. The implications of non-payment are at the discretion of each lender's terms and conditions. You must contact the lender immediately if you foresee an issue with paying your loan. If your loan payment is rejected for any reason by your bank, the lender may initiate collection procedures and you will be prevented from receiving future loans from the lender until all of your payment obligations are met in full. Again, please make sure you carefully read the late payment and non-payment options/penalty from the specific lender you are matched with.

Rolling Over a Payment

If you cannot make your payment date, some lenders will let you roll over payments. However, please note that the interest will be the same as on missed payments. The best approach is to always repay the loan on time. Being late on a payment, missing a payment and /or rolling over a payment, will negatively impact your credit score.

Your Credit Score

As stated above, being late on a payment, missing a payment and /or rolling over a payment, will negatively impact your credit score. This is why it is very important to repay on time. Upon applying, a less than perfect credit score will not necessarily prevent your application from being successful. However this is at the discretion of each lender. All loans are subject to credit approval. As a condition of extending credit, the lender you may be matched with may run a credit check with major credit reference agencies.

If you have many credit checks in a given set of time, this may negatively impact your credit score. However, if you are able to make all your payments on time, this may help/improve your credit score.Renewal Policy

36MonthLoans.com works with a variety of lenders who have their own separate and distinct renewal policies. However, please note there are two types of renewals:

- Unlimited renewals- which is the most dangerous for borrowers

- Automatic and borrower-initiated renewals – which are subject to time limits

Please note once a loan can no longer be renewed, the lender must pursue avenues of collection of the amount due. Please make sure you read the terms and conditions of the specific lender you are matched with to fully understand their renewal policy. If you have any questions please contact the lender directly.

Collection Practices

In normal circumstances where you need to repay the loan, the loan provider will take your payment directly from your bank account. Depending on the lender, this is generally done by direct debit. Please review the terms and conditions from the specific lender you are matched with. However, if you fail to pay your loan and do not contact the lender to discuss other repayment options, then your file will be sent to their internal collections team. Normally they will contact you via phone, email and postal mail. If you are still unresponsive to their requests, they may send your file to an external collections agency. Again, it is very wise to always repay your loan on time.

Credit Counseling

If you have any questions or are going through financial difficulties, you have resources that can help you. These resources are normally free services that can help counsel you on setting up payment plans or getting debt advice.